The EU Carbon Border Adjustment Mechanism (CBAM): What you should know now

With the new EU Carbon Border Adjustment Mechanism (CBAM), companies will have to pay higher import duties on goods with high emission values in the future. We explain which obligations will already apply from 1 October 2023 and what this means for goods imports from third countries.

As part of the Green Deal, the European Union has created an important instrument in emissions trading with Regulation (EU) 2023/956 of 10 May 2023, which applies to all companies importing goods from third countries into the EU.

Even though the Carbon Border Adjustment Mechanism will not be fully implemented until 1 January 2026, companies already have to fulfil certain obligations when importing goods into the EU within a transitional phase from 1 October 2023.

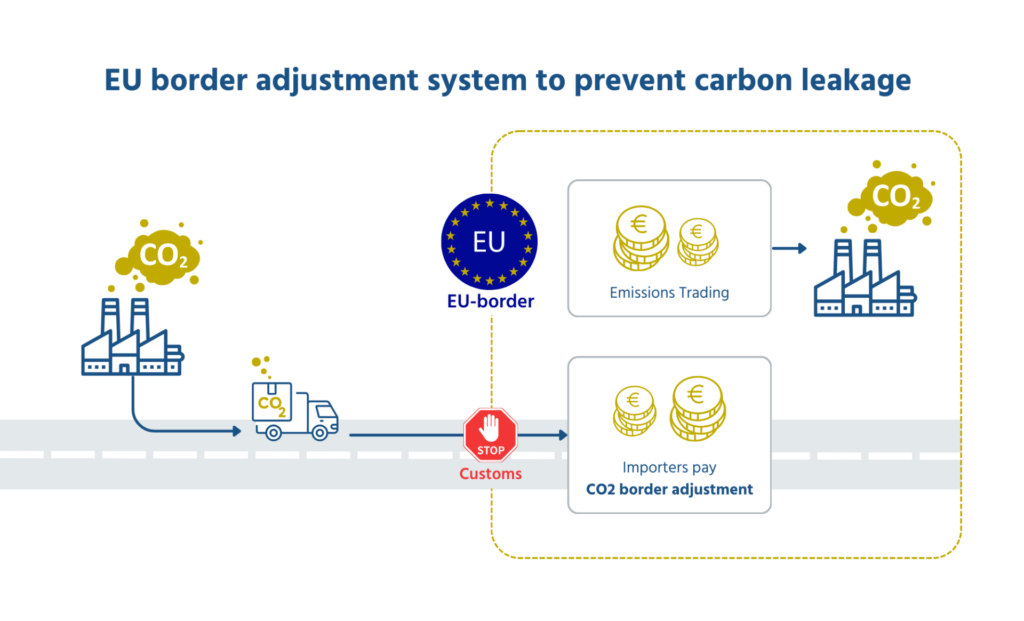

What does the CO2 border adjustment system mean for importers?

The CO2 limit offset obliges all importers of certain groups of goods and downstream products to purchase so-called CBAM certificates as compensation for the emissions emitted during the production of the goods. All importers – including private individuals – are affected for import shipments with a value of more than € 150, regardless of whether goods are imported infrequently or frequently.

On the one hand, the introduction of the CO2 border adjustment is intended to prevent companies from relocating their production and thus their CO2 emissions to countries with lower environmental and climate standards; this is referred to as carbon leakage. On the other hand, the CBAM – a supplement to the already existing EU Emissions Trading Scheme (EU ETS) – is intended to ensure that imports from third countries are subject to the same emission prices as goods produced within the EU.1 The CBAM is also intended to promote more environmentally friendly production methods in third countries.

The effects of the Carbon Border Adjustment Mechanism:2

- The import of these goods becomes more expensive due to the pricing of CO2 costs.

- Potential additional revenues from CO2 pricing of imports are to be invested in climate protection.

- Incentive for other countries to introduce CO2 pricing so that they can continue to trade freely with the EU.

What importers have to consider already from 1 October 2023?

During the transitional period, importers and their indirect customs representatives are obliged to submit a CBAM report to the EU Commission on a quarterly basis for selected HS codes. The report must be submitted within one month of the end of the quarter and can be corrected up to two months after submission. It must include:

- The total quantity of goods imported during the quarter, broken down by production facilities in the country of origin

- Information on the so-called “grey emissions” per type of goods

- Information on a CO2 price applicable in the country of origin for the imported goods as well as on CO2 prices already paid in the country of origin, if applicable (see Article 9 of the CBAM Regulation).

During the transitional phase, there is still no obligation to acquire CBAM certificates. Therefore, no costs will be charged. However, in the event of a breach of the reporting obligation, “effective, proportionate and dissuasive” sanctions may be imposed in accordance with Article 35 (5) sentence 1 of Regulation (EU) 2023/956.

What are grey emissions?

In Art. 3 Regulation (EU) 2023/956, the EU defines “grey emissions” as the sum of direct emissions released during the production of goods and indirect emissions from the generation of electricity consumed during the production of goods. If no exact values are available, the default values defined in Annex IV of the EU Regulation may be used.

Which goods are included in the CO2 border adjustment system?

The CBAM will initially only be applied to goods with a high potential for carbon leakage: Aluminium, iron, steel, fertiliser, electricity, hydrogen and cement. The CBAM takes into account both greenhouse gas emissions that occur directly in the production of products and indirect emissions that arise from the manufacture of intermediate products or the electricity required for production.3 Both certain intermediate products and some downstream products such as liquefied natural gas, petrol, heating oil, synthetic rubber, plastics, lubricants, antifreeze, fertilisers and pesticides are affected. It is expected that all products that are also subject to intra-European emissions trading will be added in the coming years.

Products / HS codes covered by CBAM:

Aluminium

7601 / 7603–7608 / 76090000

7610 / 76110000 / 7612

76130000 / 7614 / 7616

Electricity

27160000

Iron and Steel

26011200 / 7201 / 7202 11–19 / 7203

7202 60 / 7205–7229 / 7301 / 7302

730300 / 7304–7311 / 7318 / 7326

Fertiliser

28080000 / 2814 / 28342100

3102 / 3105

Cement

25231000 / 25070080

25232100 / 25232900

25233000 / 25239000

Hydrogen

280410000

Exempt from the regulation are:

- Goods and private luggage with a value of less than €150.

- Reimports of goods originating in the EU

- Imports with goods originating in Iceland, Liechtenstein, Norway or Switzerland

What rules will apply from 1 January 2026?

From 1 January 2026, only authorised CBAM declarants will be able to import the corresponding goods. It will be possible to apply for the status of “authorised CBAM declarant” with the responsible national customs authorities from 31 December 2024.

Authorised CBAM declarants will then be obliged to submit a CBAM declaration by 31 May of the following year – i.e. for the first time on 31 May 2027. This declaration must contain the following information:

- The information previously contained in the CBAM reports

- The total number of CBAM certificates to be surrendered (corresponding to the total grey emissions minus a CO2 price already paid in the country of origin).

- Copies of the test reports drawn up by accredited auditors on the grey emissions data

Approved CBAM declarants can purchase the certificates via a central, common EU platform. The certificates must be submitted together with the declaration. If the importer then does not have enough certificates, they must be purchased and a fine must also be paid.

Expiry of certificates not required

If companies have to surrender fewer CBAM certificates than they have purchased, these remain on their account in the CBAM registry. By the deadline of 30 June each year, authorised CBAM registrants can request that the EU buy back the certificates they do not need, up to a maximum of one third of all certificates purchased by the registrant in the previous year. The current regulation provides that all unused certificates will be cancelled without compensation on the cut-off date if no corresponding buy-back request is made.4

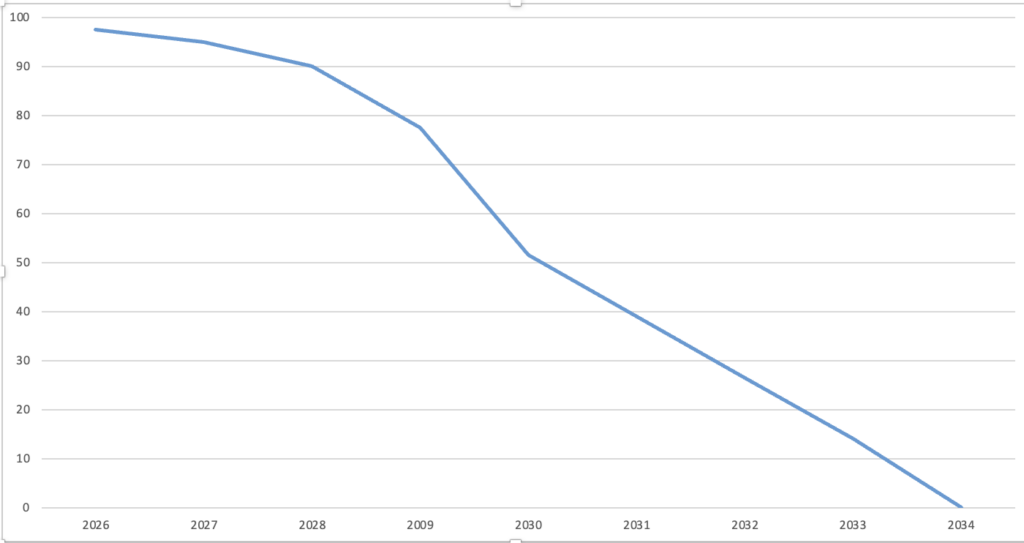

Crediting the free EU emission allowances

Currently, importers in certain industrial sectors receive free EU emission certificates to compensate for the locational disadvantage vis-à-vis third countries resulting from EU emission certificate trading. With the full introduction of the border adjustment mechanism from 2026, these free allocations will be phased out to allow affected companies to adjust economically. In 2026, CBAM certificates will only have to be purchased for about 2.5 % of the affected goods. The complete end of free allowances is not planned until 2034.5

What can companies do now?

Those responsible in companies should check at an early stage,

- whether goods covered by the reporting obligation or certificate obligation are imported from third countries.

- Whether they are re-imports or imports from Switzerland, Liechtenstein, Norway or Iceland for which no reports have to be prepared

- Who, if any, in the company is responsible for preparing the reports/declarations and complying with the reporting obligations

Furthermore, the goods should be grouped according to country of origin and production site, and suppliers should be asked about the calculation of grey emissions.

The EU Commission currently provides the following tools:

Guidelines for EU-Importers

Guidance for third country operators

Sources:

1 https://www.dihk.de/de/themen-und-positionen/internationales/handelspolitik/cbam/co2-grenzausgleich-der-eu-was-kommt-auf-die-unternehmen-zu–93624

2 https://www.ffe.de/veroeffentlichungen/carbon-border-adjustment-mechanism-cbam/

3 https://www.dihk.de/de/themen-und-positionen/internationales/handelspolitik/cbam/co2-grenzausgleich-der-eu-was-kommt-auf-die-unternehmen-zu–93624

4 Regulation (EU) 2023/956, Article 6.

5 Regulation (EU) 2023/956, Article 31.